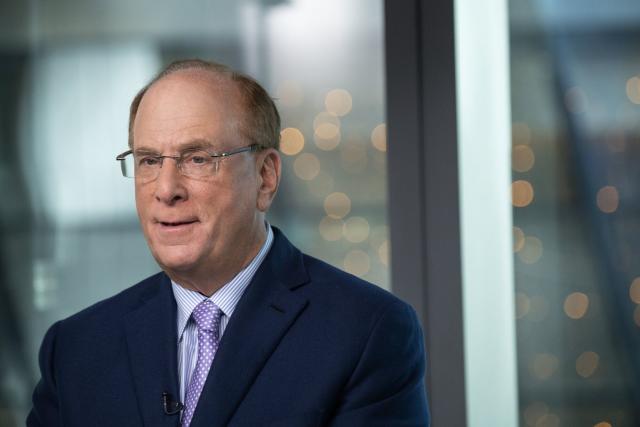

Larry Fink, the influential Chairman and CEO of BlackRock, has recently made significant statements regarding the US national debt and its implications on the economy. In his annual letters and public addresses, Fink has raised concerns about the snowballing debt situation in the United States, emphasizing the urgent need for policy changes to spur economic growth and address the mounting challenges posed by the increasing debt burden.

Larry Fink’s Warning on US Debt Crisis

Fink’s warnings about the US public debt crisis have reverberated across financial markets and policy circles. He highlights the critical nature of the situation, emphasizing that the country cannot solely rely on taxes and spending cuts to rectify the problem. Drawing parallels to Japan’s economic struggles in the late 1990s and early 2000s, Fink underscores the risks of high debt levels, particularly in managing inflation and debt servicing costs. His insights shed light on the potential consequences of an unsustainable debt trajectory and the importance of proactive measures to avert a crisis.

BlackRock’s Role in Economic Stabilization

As the head of BlackRock, one of the world’s largest asset management firms, Fink’s perspectives carry significant weight in financial markets. BlackRock’s strategies and investment decisions play a crucial role in shaping global economic trends and market dynamics. Fink’s emphasis on the need for capital markets to drive economic growth through strategic investments, especially in critical sectors like energy and infrastructure, underscores BlackRock’s commitment to fostering sustainable economic development and stability.

Addressing Economic Realities Through Innovation

Fink’s calls for innovative solutions to address the challenges posed by the national debt crisis reflect BlackRock’s forward-thinking approach to navigating complex economic landscapes. By advocating for policies that promote growth, infrastructure development, and market resilience, Fink underscores the importance of proactive measures in safeguarding economic stability and prosperity. BlackRock’s engagement in capital markets and investment strategies aligns with Fink’s vision of leveraging financial resources to drive positive economic outcomes and mitigate risks associated with mounting debt levels.

Looking Ahead: Implications for the Economy and Investors

Fink’s insights on the US national debt and economic realities have far-reaching implications for policymakers, investors, and the broader financial community. As concerns about debt sustainability and economic stability continue to mount, Fink’s recommendations for prudent fiscal policies, strategic investments, and market-driven growth strategies offer a roadmap for navigating uncertain times. BlackRock’s influence in global financial markets positions the firm as a key player in shaping economic outcomes and driving positive change in response to evolving challenges.In conclusion, Larry Fink’s leadership at BlackRock and his strategic vision for addressing the US national debt crisis underscore the critical role of financial titans in shaping economic policies and driving sustainable growth. By highlighting the urgency of addressing debt challenges and advocating for innovative solutions, Fink and BlackRock exemplify a commitment to navigating economic realities and fostering resilience in the face of uncertainty.

Key strategies proposed by Larry Fink to tackle the us national debt and economic realities

Larry Fink has proposed key strategies to tackle the US national debt and economic realities, emphasizing the importance of proactive measures to address the challenges posed by the growing debt burden. Some of the key strategies outlined by Fink include:

- Fiscal Responsibility: Fink highlights the significance of fiscal responsibility in managing the national debt. He emphasizes the need for policies that focus on lowering deficits through disciplined spending practices, particularly in areas such as defense spending, tax provisions, green subsidies, and health spending. By prioritizing fiscal discipline, Fink believes that lower deficits can pave the way for a more sustainable debt trajectory.

- Investment in Productive Growth: Fink advocates for leveraging capital markets to drive economic growth through strategic investments, especially in critical sectors like infrastructure and energy. By promoting investments that enhance productivity and innovation, Fink aims to stimulate economic growth and create opportunities for sustainable development.

- Political Will and Bipartisanship: Fink underscores the importance of political will and bipartisan cooperation in addressing the national debt crisis. He highlights the risks associated with political polarization in Washington, which can hinder Congress’ ability to make necessary fiscal decisions. Fink calls for a collaborative approach that transcends party lines to tackle the economic challenges effectively.

- Capital Markets Support: Fink emphasizes the role of capital markets in supporting economic growth and infrastructure investments. By encouraging investments in key sectors and fostering market-driven growth, Fink believes that capital markets can play a vital role in driving positive economic outcomes and mitigating risks associated with mounting debt levels.

- Global Economic Considerations: Fink also addresses the implications of rising geopolitical tensions on US indebtedness and economic weakness. He highlights the importance of maintaining investor confidence in US debt and dollar-denominated assets, underscoring the need to address debt challenges to sustain capital inflows and economic stability.

Overall, Larry Fink’s proposed strategies focus on fiscal responsibility, strategic investments, political cooperation, and market-driven growth as essential components in tackling the US national debt and navigating economic realities effectively.