The Consumer Price Index (CPI) report for February 2024 has provided valuable insights into the changes in consumer prices and inflation trends. This article delves into the key findings from the report, shedding light on the impact of various factors on the CPI and what these changes mean for the economy.

Overview of CPI Changes

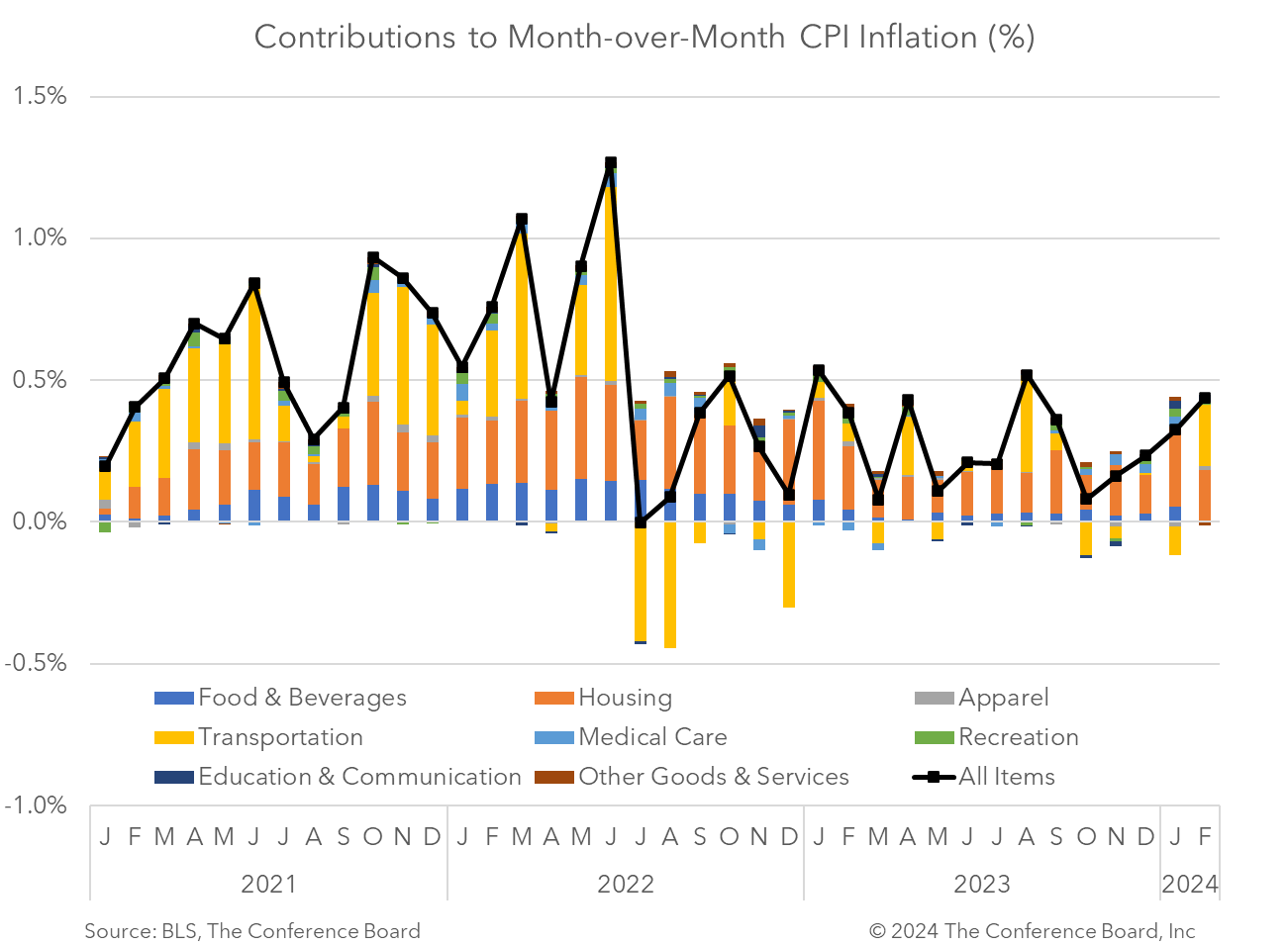

The CPI report revealed that the index for all items less food and energy rose by 3.9 percent over the past 12 months. Notable increases were observed in various categories, with the shelter index showing a significant rise of 6.0 percent over the last year, contributing significantly to the overall increase in the CPI.

Other categories that experienced notable increases include motor vehicle insurance (+20.6 percent), recreation (+2.8 percent), personal care (+5.3 percent), and medical care (+1.1 percent).

Inflation Trends

The report highlighted that overall inflation climbed to 3.2 percent last month from a year earlier, slightly up from 3.1 percent in January. When excluding volatile food and fuel costs to gauge the underlying trend, inflation stood at 3.8 percent, slightly higher than economists’ expectations but down from 3.9 percent in January.

Impact on Economic Indicators

The CPI changes have implications for economic indicators and policy decisions. The stubborn inflationary pressures observed in February indicate ongoing challenges in managing inflation rates, particularly in services inflation despite improvements in goods inflation.

Conclusion

The February 2024 CPI report provides a comprehensive view of consumer price changes and inflation trends, offering valuable insights into the economic landscape. Understanding these CPI changes is crucial for policymakers, economists, businesses, and consumers alike as they navigate through evolving market conditions and make informed decisions based on the latest data.For more detailed information and analysis on the February 2024 CPI report, readers can refer to the official release by the Bureau of Labor Statistics